Self-Service Kiosk Solutions for Banks

A banking kiosk is more than just a machine — it is a strategic extension of your branch, designed to deliver fast, secure, and user-friendly services. Whether deployed inside branches, at off-site locations, or within ATM lobbies, kiosks empower banks to provide round-the-clock access to essential services without increasing operational overhead.

Key Features of Bank Self-Service Kiosk Software Solutions

Multi-Function Transaction Support

Modern kiosks consolidate numerous services into a single interface, reducing dependency on separate counters or machines. Customers can complete multiple tasks in one visit.

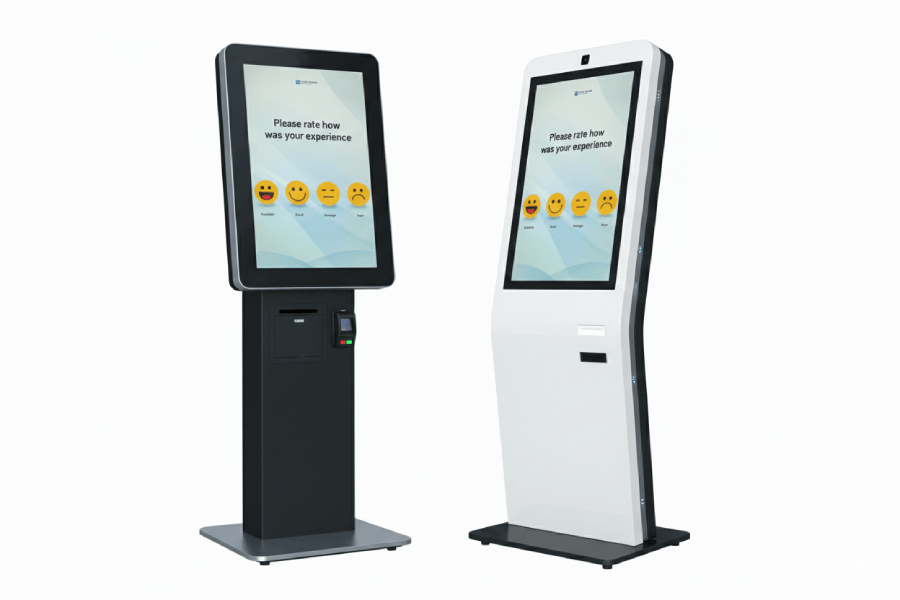

Intuitive Touchscreen Interface

Designed for ease of use, kiosks feature responsive displays, guided workflows, and multilingual support to cater to diverse customer segments.

Secure Authentication & Identity Verification

Biometric authentication, OTP validation, card readers, and ID scanning ensure transactions remain safe and compliant with regulatory requirements.

Seamless Core Banking Integration

Real-time synchronization with banking systems ensures accurate data updates, instant confirmations, and reduced manual intervention.

Automated Document Handling

Advanced kiosks can scan, print, and capture documents, supporting processes like account opening, loan applications, or compliance updates.

Cash & Payment Capabilities

Cash acceptors, recyclers, cheque scanners, and payment modules enable full transactional functionality beyond simple inquiries.

What is a Banking Self-Service Kiosk?

A self-service banking kiosk is an interactive, secure terminal that enables customers to perform various banking functions without staff assistance. These kiosks integrate with core banking systems, payment gateways, CRM platforms, and identity verification systems to ensure accurate and compliant transactions.

Cash deposits and withdrawals

Account inquiries and statements

Fund transfers

Bill payments

Card issuance and PIN changes

Loan or product applications

Our Bank Self-Service Kiosk Software Solutions Applications

Self-service kiosks support a wide variety of scenarios:

Branch automation

Handling deposits, inquiries, and transfers

Customer onboarding

Digital account opening and KYC updates

Card management

Instant issuance, activation, PIN changes

Loan processing

Application submission and document capture

Bill & payment services

Utility and credit payments

Return on Investment

Banks adopting kiosk solutions typically observe:

Reduced transaction processing costs

Improved staff productivity

Increased customer throughput

Higher satisfaction metrics

Lower error-related losses

Enhanced cross-selling opportunities

Benefits of Bank Self-services Kiosk Software Solutions

Improved Operational Efficiency

Kiosks automate routine transactions that traditionally burden tellers and service desks. This allows staff to focus on higher-value activities such as advisory services, sales, and relationship management.

Reduced Branch Congestion

Queue lengths decrease significantly when customers use kiosks for common services. Shorter wait times directly improve customer satisfaction.

Cost Optimization

By shifting repetitive tasks to automated systems, banks can reduce staffing pressure, minimize errors, and lower long-term operational costs.

Consistent Service Delivery

Unlike manual processes, kiosks deliver standardized experiences across branches, ensuring accuracy and reliability.

Extended Service Availability

Kiosks provide services beyond banking hours, enabling banks to offer greater convenience without expanding branch schedules.

Customer Experience Benefits

For customers, kiosks deliver measurable improvements:

Faster transaction completion

Minimal wait times

Privacy for sensitive activities

Simple guided workflows

Multilingual accessibility

Convenient self-paced interaction

Why Choose Unielix Technologies?

Self-service kiosks are not simply automation tools they are strategic assets. They modernize branch environments, support digital transformation initiatives, and enable banks to balance convenience with cost control.

As banking continues evolving toward hybrid digital-physical models, kiosks play a crucial role in delivering the speed and flexibility customers demand.

Modernize Your Bank with Self-Service Kiosk Software

Bank Self-service Kiosks Software Solutions FAQ's

Kiosks automate high-volume transactions such as deposits, inquiries, and payments, reducing teller workload and minimizing manual processing. This lowers staffing pressure, decreases errors, and improves transaction efficiency, leading to measurable cost savings over time.

Yes. Modern kiosk platforms are designed for seamless integration with core banking, CRM, authentication, and payment systems. Proper integration ensures real-time data synchronization, secure transactions, and consistent customer experiences.

Absolutely. Banking kiosks use encrypted communications, secure authentication methods, biometric options, and fraud prevention mechanisms. When deployed with proper security policies, they enhance transaction safety and compliance.

Kiosks can handle a wide range of services including cash deposits, withdrawals, fund transfers, account updates, card services, bill payments, loan applications, and customer onboarding. Capabilities depend on hardware configuration and software integration.